Emotional Connection: Unlocking Premium Pricing Power

See why stronger customer bonds drive price power, and get steps to build trust, align your value story, and hold premiums without added complexity.

In fast-moving tech, innovation is assumed. What now determines momentum are the new norms: AI, privacy, compliance, and credibility across ecosystems. Many firms outgrow their early story—product, sales, and marketing move at different speeds, investors and buyers can’t place them, and trust lags behind capability.

This webinar reframes brand as the operating system for growth: aligning teams, sharpening message–market fit, and signalling your place in the ecosystem before the market defines it for you.

We explore four forces shaping the sector—PMF to message–market fit, ecosystem convergence, AI as a trusted enabler, and the compliance crunch—and show how brand translates progress into confidence. We uncover where misalignment hides (inside teams, in procurement cycles, across crowded categories, and at customer touchpoints) and the push–pull moments when brand becomes a leadership lever. The through-line: own your role, prove integrity, and make your current reality unmistakable—so you’re not just known, but chosen.

Watch the full webinar replay and hear from managing partners Preetum and Dipendra Mistry as they unpack how tech and digital service firms can use brand to align, accelerate, and compete with clarity in fast-moving markets.

Over the past year, we’ve spoken with founders, CMOs, brand leaders, and GTM operators from Series A startups to established global providers. And no matter the size or stage, the same questions keep coming up:

– How do we align teams and messaging when product, sales, and marketing are moving at different speeds?

– Are we signalling the right story to investors, customers, and talent?

– How do we evolve the brand without slowing execution or losing momentum?

In technology and digital services, momentum is everything — but momentum without clarity can cost you. Across the sector, innovation is assumed. Product updates, new features, integrations — they’re table stakes. But sustained growth isn’t just about what you build. It’s about how clearly you can tell the story — to investors, to customers, and to the teams delivering it.

Right now, many companies are feeling the strain:

– Product, marketing, and sales are running at different speeds.

– Markets and investors expect a sharper, more confident story.

– Early-stage narratives no longer fit the scale or complexity of the business.

And here’s our view: In a high-velocity environment, brand isn’t an afterthought. It’s the operating system that keeps growth on track — unifying teams, aligning go-to-market, and amplifying perception before momentum starts to fracture.

To frame this, let’s examine four trends that are heavily influencing the tech and digital services sector.

According to the Brand Finance Global 500 Index, tech is the largest industry in terms of brand value at around $1.3 trillion. But the battleground has shifted. AI-fuelled entrants and well-funded incumbents are blurring categories, creating a wave of new competition.

In this environment, simply being built isn’t enough — being understood wins. The brands that lead are those moving beyond product-market fit to message–market fit — translating capability into a clear, credible growth story that investors, partners, and customers all buy into.

And one way we’re seeing companies achieve this clarity — while expanding their influence — is through the way they structure partnerships and growth plays.

We’re watching a convergence of technology, services, and ecosystems. According to Deloitte, nearly half of tech leaders (49%) pursued or planned joint ventures, strategic partnerships, or other alternative deal structures in the last year — a higher appetite than many other sectors.

The logic is clear: when product, platform, and service come together, you can deliver more value and defend more ground. But in a crowded market, brand positioning becomes the proof of fit — signalling to potential partners and acquirers that you bring credibility, strategic alignment, and a clear role in the value chain from day one.

If convergence is reshaping the ecosystem, AI is accelerating its pace.

According to IDC, worldwide spending on AI will grow at a 29% CAGR between 2024 and 2028 — embedding intelligence into operations, products, and customer experiences at unprecedented scale. AI is increasingly recognised as a foundational amplifier of other technology trends, indicating its pervasive impact across domains — from infrastructure and cybersecurity to customer engagement and GTM execution.

But the opportunity comes with a challenge: trust. KPMG’s 2025 survey shows that only 46% of people globally are willing to trust AI systems.

For the sector, winning means positioning AI as a trusted enabler — integrating seamlessly, safeguarding data, and enhancing the human judgment that drives adoption.

If AI is amplifying opportunity, regulation is amplifying complexity.

Across 2024–2025, there’s been a sharp increase in new laws and mandates shaping how technology, AI, and IT are developed, deployed, and governed. In the UK and EU, regulation is accelerating — covering platform accountability, AI risk and safety, data reform, consumer rights, and cybersecurity. In the US, activity is occurring state by state, with nearly 700 AI-related bills proposed in 2024; however, no federal framework has been established yet.

Public pressure is driving much of this shift. KPMG’s 2025 survey shows over 70% believe AI regulation is needed, yet only 43% feel current rules are adequate.

For the sector, this is more than compliance — it’s a brand imperative to demonstrate how you meet and exceed the standards that build trust in a tightening regulatory climate.

Over the past year, we’ve spoken with founders, CMOs, CTOs, and legal leads across SaaS, IT services, cybersecurity, and platform businesses. Different offerings, different stages of maturity — but the same underlying friction.

Quote 1 – CMO, B2B SaaS Company

Every product release shifts the story — our teams can’t keep messaging consistent across markets.

This SaaS CMO was feeling the pace of change with every release. The product evolves fast — but the messaging can’t keep up across regions and markets. It’s a classic growth-stage strain: when product-market fit races ahead but message–market fit lags, you risk leaving buyers unclear on your value and trajectory.

Quote 2 – CEO, IT & Managed Services Company

Integrating services and platforms is easy on paper — harder when partners don’t understand what we do.

In IT and managed services, the story often spans multiple products, services, and partners.

On paper, integration is simple — but when partners don’t see exactly where you fit in the value chain, opportunities slip. It’s why positioning in an ecosystem matters as much as the value proposition itself.

Quote 3 – CTO, Cybersecurity Company

We’ve embedded AI into workflows, but clients want proof it’s safe, not just smart. This is a big barrier for us right now.

For cybersecurity leaders, the AI conversation is everywhere. This CTO has already embedded AI into workflows — but knows adoption won’t scale without proof it’s safe, not just competent. Here, trust is as much a product feature as the technology itself.

Quote 4 – Attorney, Digital Platform

Every new jurisdiction brings fresh compliance demands — our narrative must reassure regulators and customers alike.

And in platform businesses, compliance is no longer a tick-box exercise — it’s part of the brand promise.

This legal lead faces new jurisdictional rules every quarter and understands that narrative needs to reassure regulators and customers alike. The brands that get ahead here turn compliance into a competitive advantage.

While the data indicates where the market is heading, these voices reveal what’s happening on the ground. The stakes go beyond perception — they touch revenue, relationships, and the ability to scale without losing trust.

Which brings us to the following question:

What challenges are companies in this sector facing concerning brand-led growth?

Let’s step back and connect the dots. The voices above aren’t random frustrations — they’re symptoms of something more profound: brand misalignment.

At MistryX, we use the Brand360™ Alignment Model to identify the structural misalignments that quietly undermine brand performance in the technology and digital services sector.

Below is a diagram to show the four lenses that shape how your brand is perceived — internally and externally:

– Internal Alignment: Are your leadership, teams, and culture telling the same future-focused story?

– Market Pressure: Are you keeping pace with evolving buyer expectations, procurement criteria, and category shifts?

– Competitive Positioning: Can you clearly signal your role and advantage in a crowded, converging ecosystem?

– Customer Experience: Do your touchpoints deliver the confidence and trust your brand promises?

And here’s the reality — even small misalignments in one lens ripple across the others.

In a sector where categories blur, cycles shorten, and buyers self-educate before they ever speak to you, these gaps can slow momentum faster than you realise. Let’s break it down.

Lens 1: Internal Alignment

In tech and digital services, we often see brands that haven’t caught up with the business they’ve become. Visuals, messaging, and tone still echo the early days — while the company has expanded into new markets, capabilities, and partnerships.

Add to that the founder–operator divide: where visionary goals collide with operational priorities as you scale. Without a shared, up-to-date narrative, especially across distributed teams and multiple geographies, internal misalignment shows up externally. It slows traction in pitches, on the website, and in every customer interaction.

The market dynamics in this sector are changing at a rapid pace.

Security, privacy, and AI governance now shape procurement shortlists. Buyers want ROI proof before committing to pilots, and shrinking risk tolerance is lengthening enterprise cycles while raising the entry bar. For leaders used to a longer runway and relationship-led sales, the compression is real. What once differentiated you — technical credibility, reliable delivery — is now expected. If your positioning doesn’t evolve with the pressure, perception erodes quietly but decisively.

Competitive lines are blurring. Feature parity fuels noise, and category convergence makes it harder for buyers to see what’s unique about you. We see this especially in ecosystem plays, where it’s unclear whether you’re a platform, a partner, or a point solution. That lack of narrative ownership weakens commercial impact.

The truth is, you might be delivering incredible value — but if the market can’t place you quickly and confidently, you get outpaced by competitors who claim the space first.

This is where misalignment becomes visible to the buyer. Onboarding and documentation often fall short of the promises made during the sales cycle. Support and transparency — particularly in enterprise contexts — don’t meet the standard your brand has set. When those gaps appear, they don’t just affect retention — they undermine the credibility of your solution itself.

So when a technology or digital services brand says, “Our message isn’t landing,” it’s rarely just a marketing problem. It’s usually these four forces drifting out of sync — quietly eroding clarity, credibility, and commercial momentum. And in a sector where first-mover perception matters as much as first-mover advantage, those gaps widen quickly.

Realignment isn’t about a new logo or tagline — it’s about reconnecting the brand to the business reality so every lens reinforces the others. That’s what turns friction into momentum.

In the technology and digital services sector, brand rarely climbs the priority list in a neat, planned way. More often, it’s triggered by a market shift, competitive move, or a strategic inflection point you can’t ignore. We call these push–pull forces — the moments where brand becomes a boardroom topic, not just a marketing one.

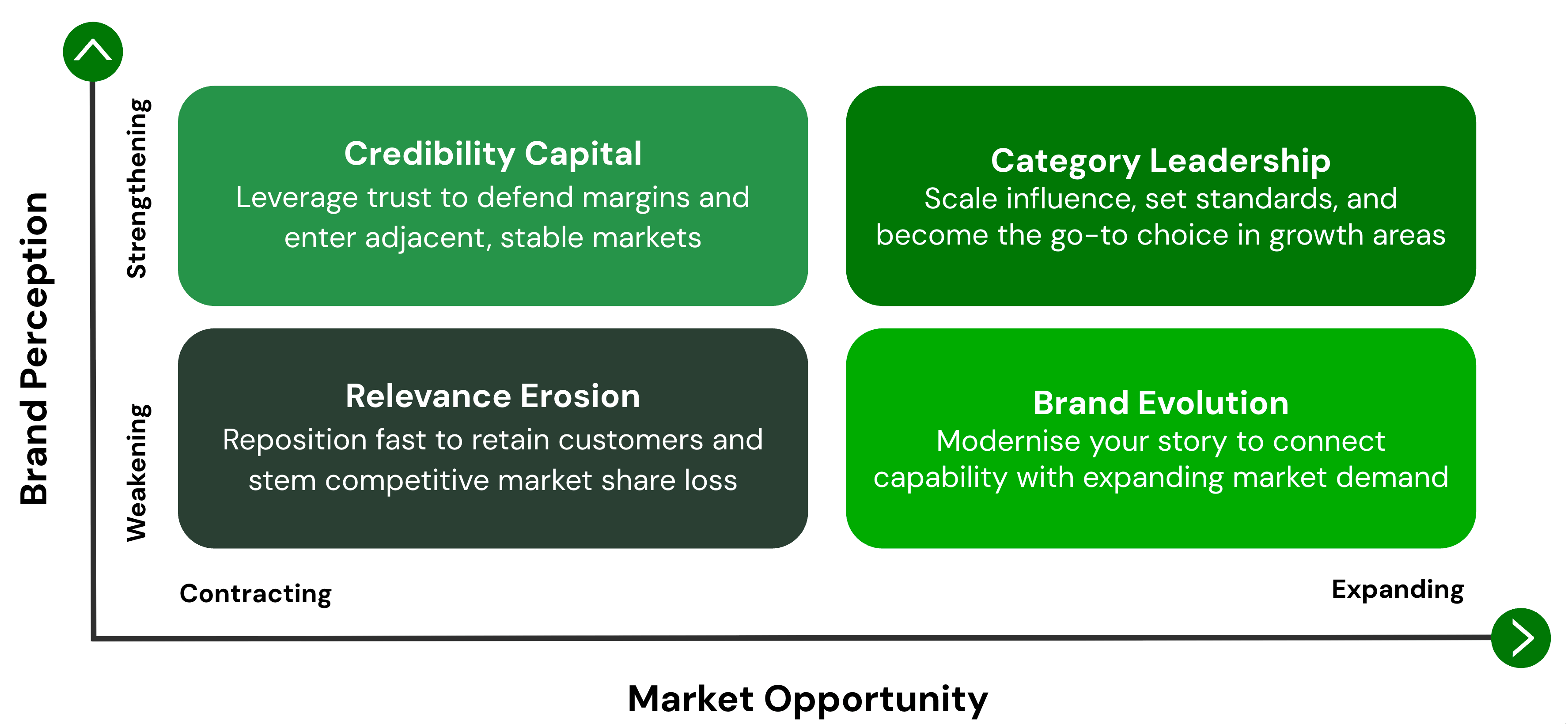

We’ve mapped these moments across two dimensions:

– On the Y-axis, brand perception — how the market sees your credibility and value

– On the X-axis, market opportunity — whether external demand is opening up or contracting

The four quadrants represent the brand decision points we most often see across tech and digital services.

(Strong brand perception, expanding market opportunity)

Here, both perception and opportunity are high — you’re in a position of strength, but the question is: will you lead, or just participate? It often shows up when:

– An enterprise platform dominates in one market but hasn’t claimed global thought-leadership status

– An IT services leader outperforms peers in delivery speed and security but isn’t known for it

– An infrastructure provider leads in technical benchmarks but loses mindshare to louder competitors

(Strong brand perception, contracting market opportunity)

Now — same strong perception, but in a cooling market. Growth may be slower, but your reputation remains a valuable asset. The play here is defence, not retreat.

We see it when:

– A managed services firm transitions into a platform-plus-services model

– A SaaS product expands into an end-to-end ecosystem with integrations and partnerships

– A telecom provider moves from commodity connectivity to enterprise transformation consulting

(Weak brand perception, contracting market opportunity)

This is the danger zone — where market momentum is slowing, and perception is fading. It’s often triggered by:

– AI-enabled competitors redefining speed, cost, or experience expectations

– Win rates slipping despite feature parity or better delivery

– Channels and content feeling outdated or disconnected from buyer needs

(Weak brand perception, expanding market opportunity)

Finally — Brand Evolution. This is where opportunity exists, but the brand story hasn’t caught up with the business.

We see it when:

– A product-led company shifts to a solutions or ecosystem model

– A merger or acquisition creates a new, broader capability

– Founders step back, and a new leadership team needs to reset the vision

Each of these quadrants feels different on the surface — but they share one truth:

At moments of inflection, aligning brand strategy with business strategy is what converts potential into sustained momentum.

The tech and digital services companies that act early use their brand to control the narrative, set the terms of competition, and build lasting advantage.

Those who delay? They end up reacting from a weaker position — with less clarity, higher costs, and fewer choices.

Earlier, we saw how misalignment across perception, positioning, and delivery can quietly erode a tech brand’s advantage. But we also saw — in the quadrant model — that decisive leaders act when market opportunity and brand perception intersect.

Here we distil four high-leverage plays we’ve seen work across the sector, from SaaS scale-ups to enterprise platforms. Each one uses brand to drive business momentum, not just awareness.

In technology and digital services, capabilities can double in a year — but if your brand narrative hasn’t moved, the market still sees the old you. We’ve seen AI platforms still described as “niche tools” long after expanding into enterprise ecosystems, and managed service providers still framed by outdated service models.

Refreshing positioning is about making your current relevance unmistakable — aligning what the market hears with what you can actually deliver now — and making your brand the visible proof of that evolution.

In the push–pull forces section, we saw how shifts in perception can open or close market opportunities.

Here’s one of the biggest shifts: moving from “vendor” to “strategic keystone.”

If you’re just one of many options in procurement’s spreadsheet, you’re vulnerable. However, when you own your value chain position — demonstrating how you enable scale, resilience, or compliance for others — you become hard to replace. Brand gives you the language, proof, and positioning to secure that strategic seat.

That’s why ecosystem framing matters: it lifts you from a cost line to a strategic investment in your customer’s success.

Earlier, we demonstrated how market pressure now includes heightened scrutiny on security, privacy, and AI governance. This is where innovation alone isn’t enough. Buyers want to know that what you build won’t just work — it will be safe, transparent, and defensible.

The brands that win strike a balance between their innovation story and proof of integrity, featuring transparent processes, measurable outcomes, and a positive human impact. That combination doesn’t just win deals — it accelerates adoption because trust removes friction from the buying process. Brand is the shorthand buyers use to decide if that trust exists before they even meet you.

Finally — compliance. Too often, it’s treated as a cost of doing business. But in this sector, leaders use it as a growth lever.

Microsoft, for example, didn’t just meet global data privacy standards — they built their “Trust Centre” as a public, constantly updated hub to show precisely how they comply and exceed requirements. It became part of the brand, signalling to customers and regulators that they set the bar, not follow it. When you treat compliance as part of your value story, it shifts perception from a “safe choice” to the “category leader.”

We’ve highlighted the patterns, pressures, and opportunities shaping this sector. Now let’s look at what it actually looks like when companies put brand to work — not just for awareness, but for momentum. Here are six industry examples — all different in scale, geography, and offer — but united by a commitment to clarity, credibility, and commercial relevance.

1. Accenture – IT & Managed Services

Accenture is a perfect example of brand aligning with evolving service breadth.

– They’ve reframed from a technology implementer to a transformation partner — language and casework now highlight business impact, not just delivery.

– Their acquisitions are woven into a single, cohesive story, reducing the fragmentation we often see in global IT groups.

– And by embedding sustainability and responsible AI into their brand promise, they’ve turned market pressures into points of differentiation — directly echoing the “market pressure” lens we explored earlier.

Salesforce shows how a SaaS leader uses brand to own a category narrative.

– “Customer 360” is more than a product bundle — it’s a unifying idea that positions them as the ecosystem hub.

– Their events, like Dreamforce, aren’t just marketing — they’re brand theatre, creating high-touch experiences that turn users into advocates.

– This is the “category leadership” quadrant in action: expanding market opportunity while reinforcing their perception as the default choice.

In cybersecurity, trust is the ultimate currency — and CrowdStrike has built it into their brand DNA.

– They lead with proof: breach prevention metrics, threat intelligence, and public incident response case studies.

– The Falcon brand architecture turns a complex platform into an understandable, ownable system — reducing the “feature noise” challenge we highlighted earlier.

– They’ve become the visible authority in their space, showing how thought leadership can precede and accelerate sales cycles.

Spotify illustrates how brand evolves to keep pace with both platform scale and market culture.

– Their annual “Wrapped” campaign is a masterclass in humanising data — turning usage stats into personal stories.

– The product experience and external campaigns are tonally consistent, reinforcing the “say it, show it, live it” principle from earlier.

– They’ve shifted from just a music streaming app to a cultural platform — deepening relevance and defending against commoditisation.

BT demonstrates the role of brand in modernising legacy perception without losing heritage.

– The “Beyond Limits” platform reframes them from a utility to an enabler of business transformation.

– They’ve aligned internal culture with the external brand through innovation labs and visible leadership engagement.

– This tackles the “brand evolution” challenge — ensuring the story reflects new capabilities, not just historical strengths.

Uber’s transformation from “ride-hailing disruptor” to a multi-service platform shows brand adaptability under scrutiny.

– They addressed trust and safety head-on with visible changes, not just messaging — aligning promise with delivery.

– The brand now integrates mobility, delivery, and freight into one ecosystem narrative — making the shift from a single-service app to a platform brand.

– This reflects the “credibility capital” quadrant: protecting reputation while expanding into adjacent opportunities.

Different markets, different business models, different routes to scale — but one shared truth:

When brand is tied to business strategy, it shapes perception, drives relevance, and strengthens market position.

In tech and digital services, the companies getting this right aren’t just better known — they’re harder to displace.

We’ve explored how leading tech and digital services firms turn brand into momentum — from seizing category leadership to closing credibility gaps. Now, let’s bring that conversation into your organisation.

The quickest wins in this sector come from closing the gap between what you are now and what the market still thinks you are. In tech, that gap widens fast — especially when your product evolves quicker than your story. We’ve seen firms launch major capabilities while still selling yesterday’s proposition, losing deals to slower competitors with sharper narratives.

Your priority? Audit for misalignment, fix the obvious friction points, and arm your teams with a single, future-facing story they can all use tomorrow.

Tech markets don’t stand still — but neither should your brand. Regulatory shifts, AI-driven disruption, or a new category-defining player can reframe buyer expectations overnight. This is where push–pull forces come into play. The leaders we’ve worked with don’t scramble — they have the narrative discipline to adapt positioning without losing direction.

The question is: Are you controlling the frame, or letting the market write your story for you?

The most valuable brands in tech aren’t optimised for today — they’re architected for what’s next. That means your brand systems, story, and internal culture are designed to scale with every innovation cycle. If your positioning still anchors in early wins, it risks irrelevance the moment the next platform shift hits.

Long-term advantage comes from a brand that evolves as naturally as your product roadmap — always ready for the next wave, not catching up to it.

See why stronger customer bonds drive price power, and get steps to build trust, align your value story, and hold premiums without added complexity.

Tech's $1.3T brand value shows clarity and consistency scale advantage. See which plays to adopt to embed brand as a system.

Shift your tech positioning from features and price to outcomes to avoid commoditisation. Gain pricing power, faster sales, and stronger team...